We’re at the mid-point of the year, so I figure it’s a good time to give an update on where I stand with the budget. The format will mostly follow that of the year-end reports with fewer graphs because analyzing only six months’ worth of data isn’t as interesting for certain categories.

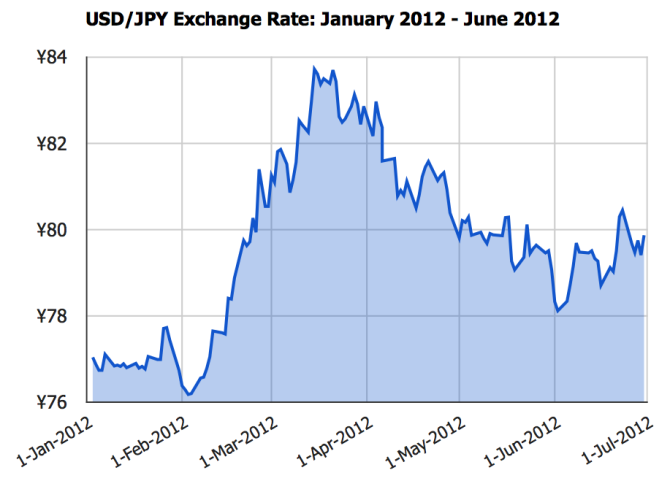

Exchange Rate Trends

First off, let’s see how the US dollar has fared against the Japanese yen in 2012.

The dollar had a nice run against the yen during the month of February and most of March before falling back in the direction of the late 2011 funk. We’re still doing better than six months ago, but I’m not really seeing a positive, mostly upward trend that I was hoping the February run would signal.

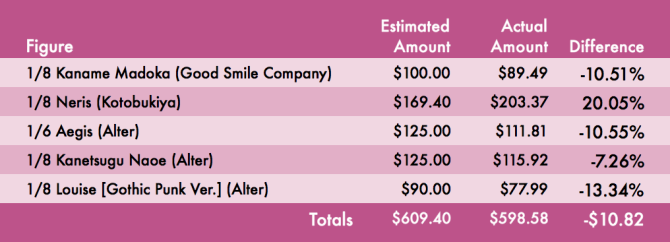

2011 Final Numbers

With the arrival of Alter’s goth-punk Louise, all open orders from 2011 are now closed, which means I can provide actual figures for each transaction where I might have had estimates previously.

Here are the values that changed since the 2011 year-end report.

The uptick in the USD/JPY exchange rate during the first half helped most of my open preorders come in lower than anticipated, with Neris being the lone exception due to an unexpected bump from SAL to EMS shipping. The net result is that I get a small amount more to play with for the remainder of the year.

And here is the full table with all final values.

I won’t post updated graphs of any of the other charts in the year-end report because none of them were affected by the price shifts noted above.

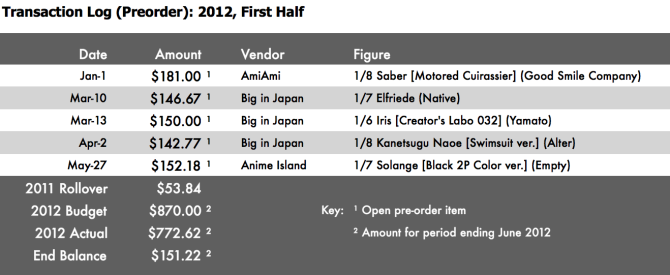

2012 First Half Numbers

As you may recall, I’m splitting the budget for this year into two parts: a preorder-only portion based on a monthly rolling budget and general purpose portion based on a lump sum allocation. I will be addressing each individually.

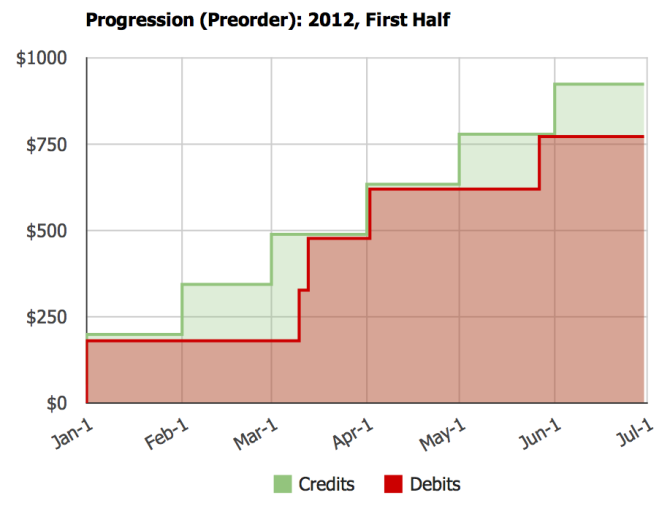

Preorder Analysis

Here’s the transaction log and progression so far for the preorder portion of the budget.

Nothing too surprising here. I tend to use funds as they become available, so you see that the debits trend line closely follows the credits line. The magnitude of the prices are notable, but I’ll cover that point separately in a moment.

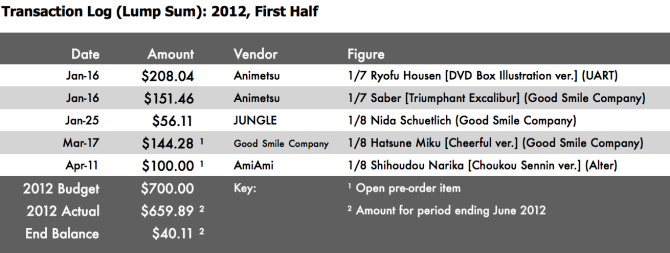

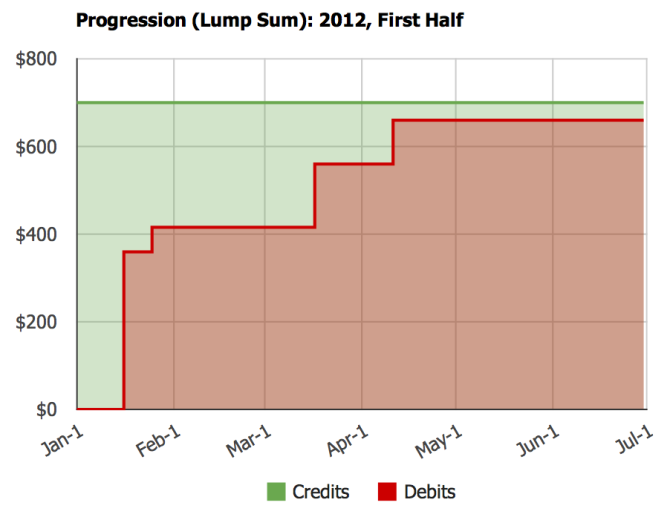

Lump Sum Analysis

Here’s the transaction log and progression graph from the lump sum side.

That didn’t last long, did it? I used about 60% of the lump sum budget in January alone on secondary market purchases. I definitely don’t regret picking up Ryofu–she’s an awesome figure–but GSC is reissuing Saber, so I now know I could have saved a little if I had waited for the re-release. Another 35% was used toward a couple preorders for which I didn’t have money in the main preorder budget at the time.

I’m hoping to sell a few older figures from my collection to bolster the lump sum budget a bit in the second half.

Pricing Analysis

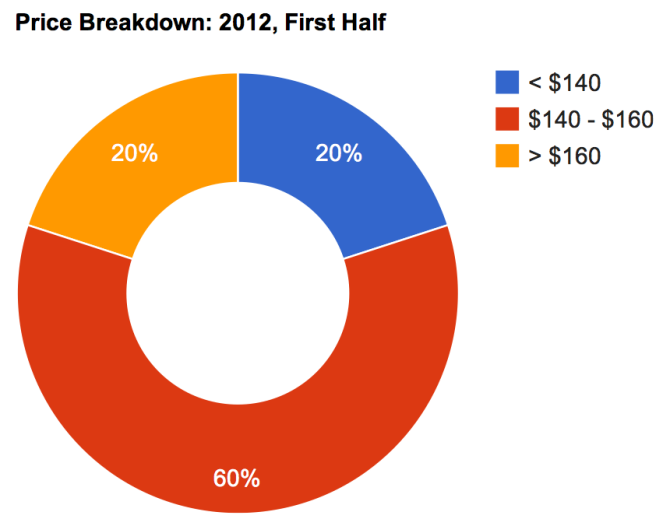

I won’t get into the fully set of analysis I typically do for the year-end reports, but I did see some interesting trends with pricing in the first half, so let’s look at that breakdown now. I noticed an interesting distribution of orders right around the $150 mark, so I decided to forgo the usual $25 ranges from prior year-end reports.

Last year, only 2 of 13 (~15%) of figures purchased fell into the $140+ range versus 80% from the first half of this year.

While figure prices subjectively seem to be trending upward, I would chalk this rather dramatic shift up more to spending patterns than an indication of where the broader figure market is at, currently. I had four exclusives (up from one last year), which are by their nature more expensive than most normal releases, plus two pricey secondary market pick-ups (versus one in 2011). I honestly thought it a bit of a reach when I budgeted extra for three exclusives this year and yet I somehow managed to exceed that many in the first half alone.

That’s it! Check back at the end of the year for the full year-end report.

Credits: (header image source)

Very well presented data! What program do you use to make all those beautiful charts and graphs? =3

All the trend and pie charts come from Google Docs. I had to use the workaround described at http://webapps.stackexchange.com/a/24858 to grab higher resolution images, because Google doesn’t give any control over the “Save Image” settings when exporting charts.

oh oh thank you! 😀

Wow such a detailed report, you really like this analysis stuff. inspired by one of your earlier budget posts, I also made a little list with figure purchases, prices, shipping and custom fees.

So far I paid for 11(what!?) figures in 2012, overall 1096 €. Around 16 more will come in the second half, I’m thinking about canceling three ones because of budget and also space reasons.

I do like to (over)analyze things. I guess it’s the curse of being an engineer.

Nice! Are you finding your list helpful? In addition to the various costs, I also keep track of shipping and arrival dates for each figure, so that I can try to estimate transit times for methods like SAL, which aren’t trackable.

Who do you place most of your orders with? I usually don’t feel the need to cancel orders, but I was under the impression that most shops don’t accept cancellations.

Ah I see, I assumed that it was inspired by the tasks you do at work ^^

Yeah it actually helps me to plan my monthly expenses, I can see which figures will arrive each month and if I can take another figure order without running into money problems.

On the other hand it’s scary to see the expenses, but well I love that hobby with passion.

Im an AmiAmi customer most of the time. Hehe the big shops always say that they usually accept no cancellations, but as long as you keep it to a minimum they won’t decline such a request from good customers. In general I really think about the figures I purchase, do I need them? should I place another order? But sometimes I get unsure about a purchase, one or two cases each year.

I tend to find these posts you do quite interesting and make me wonder about my own spending. I’m too scared to actually find out in detail how much money I sink into this hobby to actually go through and find out though.

Looking at your graph though, I too am a bit disappointed with the Yen trends against the dollar but I suppose I should be happy that it has been staying around the 80 Yen/1 USD mark for a while.

The raw numbers can certainly seem scary, but if you can frame them in the context of your financial means and your personal priorities you may find there’s no cause for alarm. I certainly don’t think it’s unreasonable to invest a fair bit more than the average person in areas that interest you greatly.

I’m not sure what to make of the dollar situation. I have a feeling that results of the election later this year will cause some movement in one direction or the other, but it will likely be a temporary blip.

Wow, what detailed information. It’s great that you keep track of this stuff. Too many collectors blindly buy buy BUY without realizing just how much money they’re sinking into the hobby. I was this way at the start, but both the weakening dollar and rising figure costs have forced me to become much pickier with what I buy. I’ve missed out on a lot of great figures but it’s really for the best. Not having MegaHouse’s Moonlight Dancer Lunaluna or Gift’s Saber Lily isn’t going to kill me…

…but I sure would like to get them. ;_; At least I have more money on the side now.

I did some rounding up here and there but all of my current 2012 pre-orders (both released and unreleased) should come up to under $1500, WHICH IS A LOT! And this is AFTER I’ve cancelled several pre-orders…

I didn’t used to keep track of my spending on figures, either, but at some point I noticed that I was buying a lot more figures than when I was starting out with this hobby, so that’s when I decided to put a system in place to keep things sustainable. I’ve also definitely missed out on some great figures that I rather regret, but working within a set of constraints is sort of a personal challenge that I enjoy for the most part and I feel the process leads toward a higher quality collection at the end of the day.

It is a lot. Unfortunately, this hobby has become significantly more expensive than it was when I was starting out. I remember paying $40-60 for my first quality scales from the likes of Alter and Max Factory back in 2006. Our poor economic situation is partly to blame, but I’m sure some of it is just the natural course of inflation.